Original source: LEDinside

2023-07-28

2023-07-28  0

0

In early May, after Mulinsen took the lead in announcing a 5% to 10% increase in the price of the entire series of products, a wave of price increases spread from top to bottom in the LED industry.

According to TrendForce’s survey, some LED manufacturers have adopted price hike measures, and the main price increase items are concentrated on upstream lighting LED chips. The price is the most, and the increase is about 3~5%; the increase of special size can reach up to 10%.

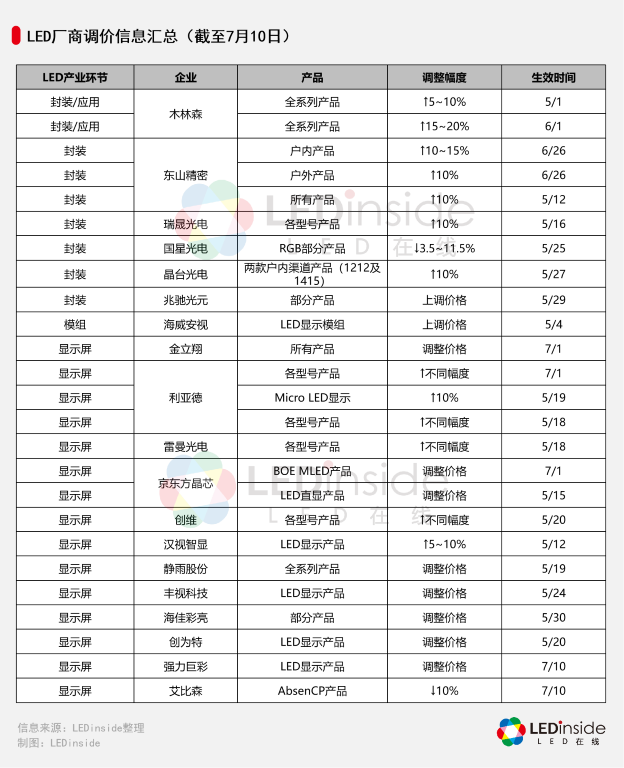

According to the current price adjustment letters released by LED manufacturers, LED packaging companies such as Dongshan Precision, Ruisheng Optoelectronics, Jingtai Optoelectronics, Zhaochi Guangyuan, etc., Leyard, Jinlixiang, Lehman Optoelectronics, BOE Jingxin, Haijia A total of 17 LED display manufacturers such as Cailiang announced an increase in the price of LED display products, with an increase of about 5% to 10%.

On the other hand, packaging manufacturer Nationstar Optoelectronics and LED display manufacturer Absen announced to lower product prices. Among them, China Star Optoelectronics lowered the price of RGB products by 3.5%~11.5%; Absen lowered the price of commercial display AbsenCP series products by 10%. .

It is worth noting that some packaging and display companies have also raised the price of LED products twice, such as Mulinsen, Leyard, Jinlixiang, Dongshan Precision, etc.

The participation of the upper, middle and lower reaches has started a new round of price increases in the industry. Does this mean that the industry has passed the lowest point of the LED industry in recent years and ushered in a new cycle of growth? Perhaps it is necessary to explore the reasons behind this round of LED price increases. logic.

Reason 1: Rising raw material prices and falling product prices

In 2022, the global LED terminal demand will decline significantly, and the LED lighting, LED display and other markets will continue to slump. The unsatisfactory demand for terminal LED products has intensified the competition in the industry, and most companies have sharply reduced prices for products to clear inventory.

On the other hand, in the past three years, due to the comprehensive influence of macroeconomic environment, geopolitical factors and other aspects, all walks of life are facing the problem of supply chain imbalance. The resulting shortage of raw materials and rising production costs have continued to affect enterprises. cause stress.

Each company mentioned in the price adjustment letter that fluctuations in raw material prices and continuous decline in product prices are one of the main reasons for LED manufacturers to raise product prices this time.

In terms of LED packaging device suppliers, Dongshan Precision mentioned in the price adjustment in May that since the beginning of 2022, the price of lamps has continued to decline, which has brought huge troubles to the company's operations. In order to ensure high-quality products and better services, Continue to operate steadily, better cope with the current pressure and challenges, and decide to increase product prices.

In June, Dongshan Precision issued a price adjustment letter again, and said that after a long period of low utilization rate and destocking production status, the company's current inventory of various models has become normal, but it is still in a state of serious cost inversion, so the product price is raised again .

Zhaochi Guangyuan said that due to factors such as the cost of chips and some materials, and the increase in personnel wages, the delivery price of some products will be raised. Ruisheng Optoelectronics mentioned that in the past year, product prices have continued to fall, while bulk product prices have continued to rise, which has caused a considerable impact on the industrial chain, resulting in a serious inversion between costs and product prices.

The price increase behavior of upstream packaging and chip links has driven LED display companies to simultaneously increase product prices. Among them, Leyard said that the increase in the supply cost of upstream main raw materials (mainly semiconductor chips and lamps) has led to the continuous increase in the production and manufacturing costs of the company's LED display products.

In the face of fluctuations in terminal demand, companies maintain normal operations by cutting prices and promoting sales. However, in the long run, under the condition of continuous fluctuations in raw material prices, such a strategy has not brought much positive impact to the company, but has further increased corporate profits. compression.

Reason 2: The market is sluggish, and the performance of LED manufacturers is under pressure

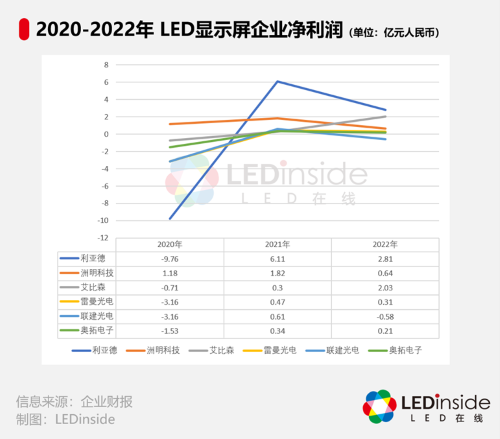

Facing the decline in demand under the background of the depression in the general environment, the price reduction strategy failed to make most LED companies escape the result of declining performance.

Relevant statistics show that in 2022, among the 140 LED-related listed companies, only 63 will achieve year-on-year growth in annual revenue, and 60 will achieve year-on-year growth in annual net profit, accounting for about 45% and 42.86% of the total number of companies respectively.

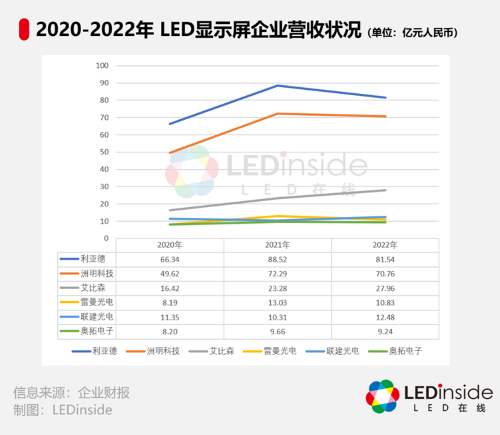

In the field of LED displays, despite the rapid recovery of overseas market demand in 2022, the domestic market demand is not good. Against this background, the revenue and net profit of most LED display companies declined last year.

In the field of LED lighting, overall, the scale of the LED lighting market is showing a downward trend. According to TrendForce's "2023 Global LED Lighting Market Analysis - 1H23" analysis, multiple factors will cause the global LED lighting market to fall back to US$61.4 billion in 2022, a year-on-year decrease of 5%.

The chain reaction brought about by poor downstream demand has led to a decline in the LED performance of mid-upstream packaging and chip companies. For example, chip companies such as Qianzhao Optoelectronics, Azure Lithium, and Jucan Optoelectronics in the upstream; the LED-related businesses of packaging companies such as Dongshan Precision, Nation Star Optoelectronics, and Mulinsen in the midstream will all experience a decline in revenue and profits in 2022.

According to TrendForce, the decline in terminal demand has led to a reduction in the capacity utilization rate of the upstream LED chip industry, resulting in an oversupply in the market and a continued decline in prices. According to TrendForce research, the drop in volume and price will lead to an annual decrease of 23% in the output value of the global LED chip market in 2022, to only US$2.78 billion.

In 2022, the global LED packaging scale will be 14.2 billion US dollars, a year-on-year decrease of 19%, among which the LED lighting packaging field has the most obvious decline. In the field of LED display packaging, affected by the price drop and the decrease in downstream orders, the annual market size was US$1.45 billion, a year-on-year decrease of 16%.

Entering 2023, society will return to normal operation, but there are still many companies whose performance in the first quarter has declined. Relevant statistics show that in the first quarter of 2023, about 128 LED-related listed companies announced their performance, of which only 41 achieved year-on-year growth in revenue, and 57 achieved year-on-year growth in net profit, accounting for about 32.03% and 44.53% of the total respectively. %.

Therefore, the downturn in the LED industry from 2022 to the first quarter of this year has led to continued pressure on corporate performance, which is also one of the reasons why some LED companies have increased prices. From the perspective of the long-term development of enterprises and the industry, in fact, the price increase behavior of LED enterprises has also allowed the enterprises to return to a relatively normal operating state, weakening the negative impact of raw material price fluctuations, improving the profitability of enterprises, and continuously bringing high-quality products to customers. At the same time, the product drives the industry to return to a benign competitive environment.

Reason 3: The recent industry demand is gradually picking up; LED emerging applications are gradually growing

In addition to the decline in corporate profitability, the recent recovery in market demand is also one of the reasons for the price increase in the LED industry chain. In 2023, the LED industry will gradually recover and the recovery of LED lighting market demand will be more obvious.

According to TrendForce’s analysis, LED commercial lighting is the fastest-recovering application in the overall LED lighting market. From the perspective of the supply side, the LED lighting industry has entered a trough since 2018, leading to the withdrawal of some small and medium-sized players. Other traditional lighting supply chains The industry has also shifted to display and other high-margin markets, resulting in reduced supply and low inventory levels.

Since the main suppliers of global LED lighting chips are concentrated in China, the price of low-power lighting chips in the Chinese market is the first to rise this time. In the short term, it is a measure taken by the industry to improve profitability; in the long run, it is a process in which companies gradually return the industry to normal by adjusting the balance between supply and demand and increasing industry concentration.

In terms of LED display, under the background of the continued growth of overseas markets and the normal operation of the domestic market in 2023, the demand for LED display market will gradually recover. Jufei Optoelectronics recently stated that the current Mini LED business is progressing smoothly, with shipments rising month by month. The company's Mini LED backlight technology has been rapidly applied and promoted.

Leyard said that in the first quarter of this year, the growth rate of the Asia, Africa and Latin America markets was relatively strong; domestically, direct sales have recovered rapidly since March, and orders from several major industries, including military industry, education, and energy, have performed better.

Leyard also mentioned that the company's Micro LED products have been launched for more than 2 years. At this stage, the price continues to decline, the performance indicators are stable, and the customer satisfaction is high. At present, the supply of products is in short supply. price.

Unilumin Technology mentioned in a recent conference call that the company's orders gradually recovered in the first quarter, and market demand is gradually picking up. Display manufacturer Alto Electronics revealed that the company’s market demand for advertising and short video live broadcasts in the xR virtual shooting market is gradually increasing.

TrendForce found in its survey that the downstream demand for LED display screens has picked up, driving the demand for upstream LED display chips to pick up in June, and the capacity utilization rate of chip manufacturers has increased.

In addition to the shortage of lighting supply and the gradual recovery of domestic and overseas markets, another reason for the recovery of LED demand is the rapid rise of emerging applications for LED lighting and display. With LED performance rising and cost continuing to drop, and Mini LED/Micro LED technology being gradually optimized, companies quickly opened the door to multiple LED segments.

In the LED lighting market, subdivided fields such as plant lighting, ultraviolet lighting, intelligent lighting, health lighting, and automotive lighting all show broad development space. Among them, automotive lighting is the focus of enterprises. Stimulated by the development of domestic substitution, the demand for LED automotive lighting is rising.

In the LED display market, emerging applications such as xR virtual shooting, naked-eye 3D, all-in-one machines, cinema screens, rental screens, transparent screens, and special-shaped screens are becoming the main growth drivers of the LED display market. Electronic consumer products such as monitors, TVs, AR/VR glasses, and smart wearable devices are waiting for the further development of Mini/Micro LED technology.

Price increase is the key for the LED industry to meet large volume demand

In the short term, behind the price increase, it reflects that LED companies are facing the dual pressure of declining product prices and rising costs under the downturn of the industry and the intensification of market competition, as well as the continuous negative impact on performance. The current market demand is gradually increasing, giving LED companies an opportunity to return to normal operating conditions and a healthy market environment.

In the medium term, behind the price increase, companies are optimistic about the continued recovery of LED demand in the future. Although the international situation is complicated and the macro economy is still weak, compared with the past three years, the current domestic and foreign markets are in a relatively stable state, which increases the possibility that the demand for the LED industry will continue to pick up in the second half of this year and in the next two to three years.

In the long run, behind the price increase is that companies are optimistic about the further expansion of the future application of LED technology. Today, LED technology is mainly used in lighting, display and backlight fields. Compared with other technologies in various fields, LED has obvious application advantages. With the continuous optimization of performance cost and the rise of Mini/Micro LED technology, LED will accelerate in the future. Penetration rate within each application.

It still takes time to judge whether the price increase behavior of enterprises can represent the LED industry entering a new growth cycle. But for LED companies, the price increase is a necessary adjustment for current and future development. With the improvement of society's awareness of environmental protection and energy efficiency, the LED market is bound to continue to expand in the future. LED companies need to improve their own operating capabilities and product quality, form healthy competition in the industry, promote the sustainable development of the LED industry, and wait for the arrival of the era of larger LED demand. (Text: LEDinside Irving)

2023-07-28

2023-07-28  0

0

Scan Wechat

Scan Wechat TOP

TOP